Some people are afraid to trust Paypal with their money. That’s much better than the standard interest rates offered these days and could be a worthwhile option. Since most of us will just be opening the account for the 5% savings rate and won’t be using the debit card, we probably won’t get much out of this.Īfter accounting for the $4.95 monthly fee, the actual interest earned is around 3.8%. Based on your shopping activity, Paypal will target you with offers for various merchants.

#CHECK BALANCE ON PAYPAL PREPAID CARD FREE#

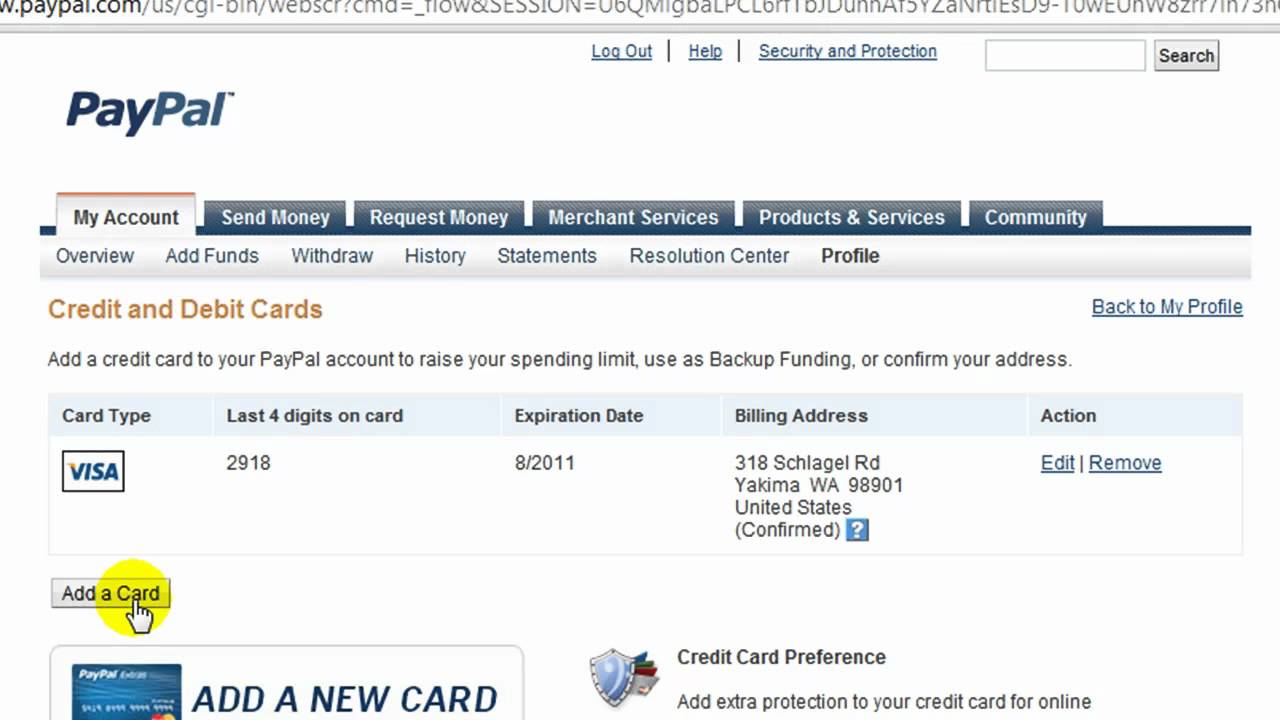

(Feel free to add your referral links in the comments, but please add some pertinent information about the topic as well.) If the referred individual had a Paypal Prepaid or any other Netspend Prepaid within the past 180 days, they are not eligible for the referral bonus. Like many similar prepaid cards, the Paypal Prepaid has a referral program which gives each of them a $5 reward when the new member enrolls and adds at least $10.From there the funds can be transferred to your bank. To get money out of the account, first transfer it from the savings to the Prepaid card, then you’ll be able to transfer it to your Paypal account. First add money to the Prepaid card using one of the above methods, then transfer the funds to the linked savings account. You can not add money to the savings account directly. First get the money into the Paypal account, then transfer it from there in $300 increments to the Prepaid card. Up to $300 per day and $2000 per rolling 30-days. Transfer funds from your Paypal account.Sending money via ACH transfer from another checking account will work as well. There are three ways to add funds to your Paypal Prepaid account.

0 kommentar(er)

0 kommentar(er)